GOP tax plan would provide major gains for richest 1 percent,

uneven benefits for middle class: report

Carolyn Y. Johnson

Washington Post

Sept. 29, 2017

The Republican tax plan would deliver a major benefit to the top 1 percent of Americans, according to a new analysis by a leading group of nonpartisan tax experts that challenges the White House’s portrayal of its effects.

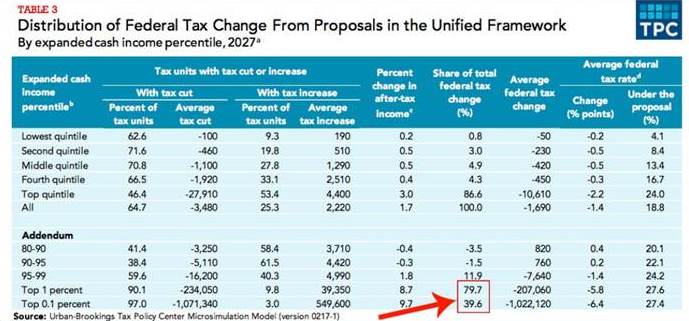

Despite repeated promises from Republican lawmakers that the plan is designed to provide relief to the middle class, nearly 30 percent of taxpayers with incomes between $50,000 and $150,000 would see a tax increase, according to the study by the Urban-Brookings Tax Policy Center.

Meanwhile, 80 percent of the tax benefits would accrue to those in the top 1 percent. Households making more than about $900,000 a year would see their taxes drop by more than $200,000 on average.

The analysis also found the plan would provide disproportionately large benefits for businesses compared to what the middle class and low-income Americans would receive.

Read the full article HERE.

The top 1% would get 79.7% of all the tax cuts under the Trump plan. The top *0.1%* would get 39.6%. (Urban-Brookings Tax Policy Center chart)